Trade Finance Operations, Digitized

Manage Letters of Credit, Documentary Collections, Bank Guarantees, and Supply Chain Finance in one platform. Built for banks and corporates who need visibility, workflow tracking, and compliance tools.

See It In Action

Explore the platform's key features

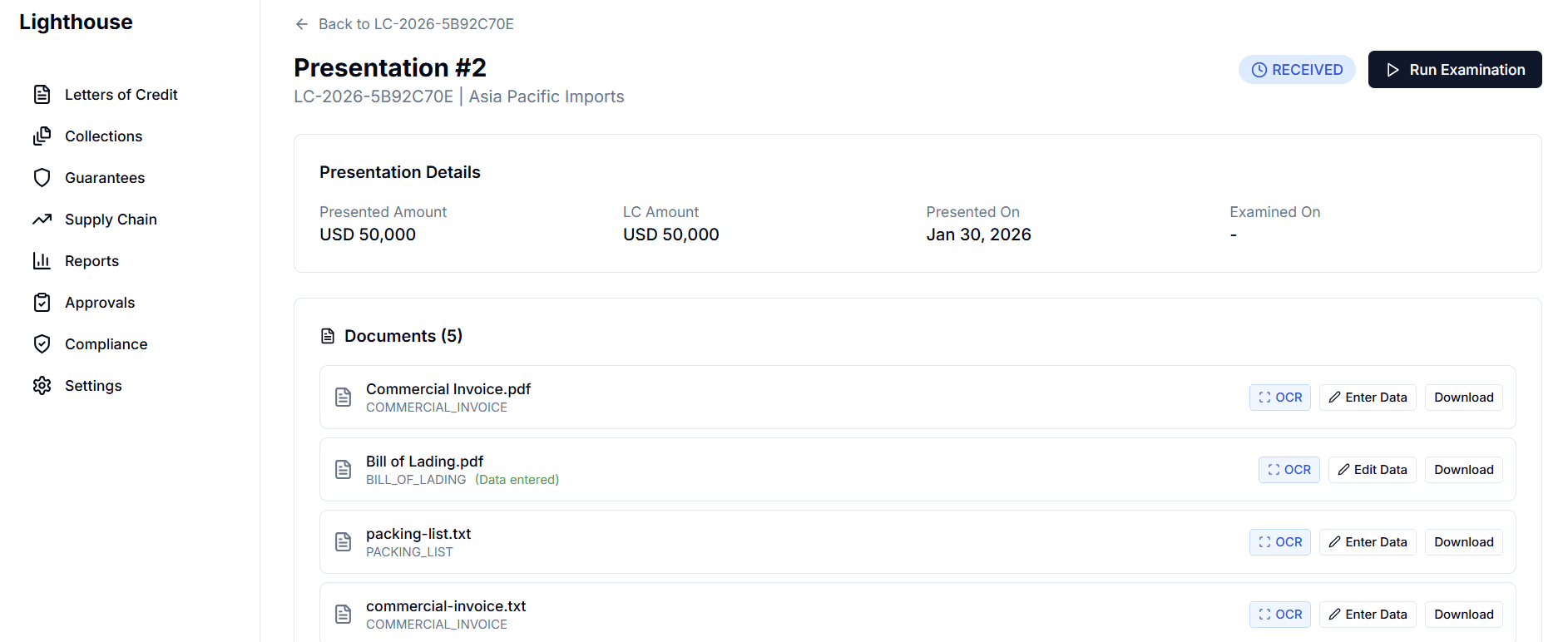

Document presentation with OCR extraction buttons

What This Platform Does

Lighthouse is a workflow and document management system for trade finance operations. It helps teams track transactions, manage documents, and maintain compliance records. Here's an honest breakdown of current capabilities.

What It Does

- Track transaction lifecycles

- Store and organize documents

- Generate SWIFT messages

- Extract data via OCR

- Flag potential discrepancies

- Screen against OFAC list

- Enforce approval workflows

- REST API with Swagger docs

What Requires Human Review

- Final document examination

- Complex discrepancy decisions

- Sanctions match resolution

- ICC rule interpretation

- Credit decisions

- OCR accuracy verification

On the Roadmap

- ISO 20022 MX messages

- More SWIFT MT types

- Commercial sanctions APIs

- Email notifications

- Multi-factor authentication

- Webhooks (push notifications to your systems when events occur)

Four Product Lines

Each product includes workflow management, document handling, and reporting. International standards are referenced for each transaction type.

Letters of Credit

Manage the full LC lifecycle from draft to settlement. Track amendments, presentations, and available balances in one place.

Standards Note: Transactions reference UCP 600 rules. Key rules like 21-day presentation deadlines and tolerance checking are enforced programmatically.

Documentary Collections

Process D/P (Documents against Payment) and D/A (Documents against Acceptance) collections with full workflow tracking.

Standards Note: Transactions reference URC 522 framework. Workflow stages align with collection procedures but full rule enforcement is manual.

Bank Guarantees & SBLC

Issue demand guarantees, bid bonds, performance guarantees, and standby letters of credit. Track claims and expiries.

Standards Note: Transactions reference applicable rules. Claim validation and extend-or-pay logic require manual review.

Supply Chain Finance

Create financing programs for reverse factoring and receivables purchase. Track invoices from approval to settlement.

Standards Note: Based on common SCF market practices. Dynamic pricing and credit scoring are roadmap items.

SWIFT Message Generation

Generate properly formatted SWIFT MT messages from transaction data. Messages can be previewed, validated, and downloaded for submission through your SWIFT connectivity solution.

ISO 20022 MX message support is planned, enabling migration from MT to the new XML-based standard as the industry transitions.

Platform Capabilities

Tools to reduce manual work and support compliance. Each capability is designed to assist trade finance professionals, not replace their expertise.

REST API

Full-featured REST API with OpenAPI/Swagger documentation. Integrate trade finance operations into your existing systems.

Create and manage LCs, collections, guarantees, and SCF transactions. Query statuses, upload documents, and retrieve reports programmatically. API docs available at /api/docs.

AI-Powered OCR

Extract data from trade documents using Google Gemini AI. Supports commercial invoices, bills of lading, packing lists, and certificates.

Extracted fields shown with confidence scores. High-confidence data can auto-populate forms. Manual review and correction always available.

Discrepancy Checking

Compare document data against LC terms to identify discrepancies before presentation.

Rules engine checks amounts (with tolerance), dates, required documents, and key field matches. Results shown with severity levels.

Sanctions Screening

Screen parties against OFAC SDN list with fuzzy name matching using Levenshtein distance and Soundex algorithms.

Potential matches flagged for compliance review. Commercial providers (Dow Jones, Refinitiv) can be integrated via adapter pattern.

Maker-Checker Workflow

Dual authorization for critical operations. Configure rules based on transaction type and amount thresholds.

Pending approvals queue with full context. Same user cannot approve their own request. Complete audit trail.

Regulatory Reporting

Generate exposure reports, fee income summaries, expired instruments lists, and country/counterparty analysis.

Export to CSV for further analysis. Dashboard shows key metrics at a glance.

Credit Limit Management

Set credit limits per bank-client relationship. Automatic utilization tracking and limit checks on new transactions.

Warnings when approaching limits. Blocks issuance if limit would be exceeded.

International Standards

Trade finance operates under ICC (International Chamber of Commerce) rules. The platform references these standards and implements key validations, but full compliance requires trained professionals.

Human Expertise Required

This platform is a tool to support trade finance operations, not a replacement for qualified professionals. Document examination, discrepancy decisions, and regulatory compliance ultimately require human judgment and expertise.

Think of Lighthouse as your digital workspace that keeps everything organized, surfaces potential issues, and maintains records—while your team makes the important decisions.

Ready to Explore?

Create a free account to explore the platform. Set up sample transactions, test the OCR extraction, and see how it fits your workflow.